Fraud Prevention Compliance Tracking Regulation Service 3481963529 3714847293 3312060074 3515165072 3512318172 3382928153

The Fraud Prevention Compliance Tracking Regulation Service, identified by multiple numerical codes, serves as a critical tool for organizations navigating the complexities of regulatory compliance. Its focus on real-time updates and comprehensive audit trails enhances operational transparency. Furthermore, the automated reporting tools streamline processes, allowing organizations to address compliance risks proactively. Understanding these elements is essential for any business aiming to strengthen its integrity and foster stakeholder trust in an evolving regulatory landscape. What implications does this hold for future compliance strategies?

Understanding the Importance of Compliance Tracking

Although organizations may perceive compliance tracking as a burdensome obligation, it is, in fact, a critical component of effective fraud prevention strategies.

Understanding compliance challenges requires a detailed analysis of tracking methodologies that ensure adherence to regulations.

Key Features of the Regulation Service

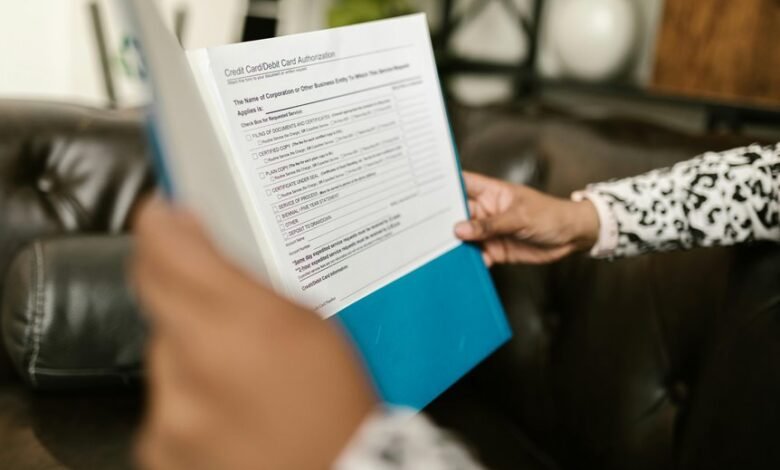

A robust regulation service is essential for organizations aiming to enhance their fraud prevention compliance tracking efforts.

Key features include real-time regulation updates, ensuring adherence to evolving compliance standards.

Additionally, comprehensive audit trails facilitate transparency and accountability, while automated reporting tools streamline compliance monitoring.

These elements collectively empower organizations to maintain rigorous oversight and proactively address potential compliance risks related to fraud prevention.

Benefits of Implementing Fraud Prevention Measures

Implementing effective fraud prevention measures offers numerous advantages that extend beyond mere compliance.

Organizations benefit from enhanced fraud detection capabilities, allowing for timely identification of suspicious activities.

Furthermore, robust risk assessment frameworks enable businesses to evaluate vulnerabilities, fostering a proactive approach to security.

Ultimately, these measures enhance operational integrity, protect assets, and cultivate trust among stakeholders, aligning with the desire for organizational autonomy and resilience.

How to Integrate the Service Into Your Business Operations

Integrating fraud prevention services into business operations requires a strategic approach that encompasses comprehensive planning and thorough execution.

Businesses should prioritize service integration by assessing current workflows and identifying potential vulnerabilities.

Implementing robust compliance tracking mechanisms enhances operational efficiency, ensuring adherence to regulations while safeguarding assets.

Continuous monitoring and staff training will further bolster the effectiveness of the integrated fraud prevention framework.

Conclusion

In the realm of business, compliance serves as a sturdy lighthouse amidst the turbulent seas of regulatory change and fraud. The Fraud Prevention Compliance Tracking Regulation Service acts as the vigilant keeper of this light, guiding organizations toward safe harbor. By adopting this service, enterprises can navigate the complexities of compliance with confidence, ensuring their operations are fortified against the lurking threats of fraud. Ultimately, this proactive approach not only safeguards integrity but also cultivates a lasting trust with stakeholders.